My Favorite Trading Tools

Per your requests, Here's what I think are the Best Trading Platforms and Stock Picking Services

I'm asked a lot about what tools I use to make money in the markets, and here they are. Some are good for beginners, others for more advanced traders.

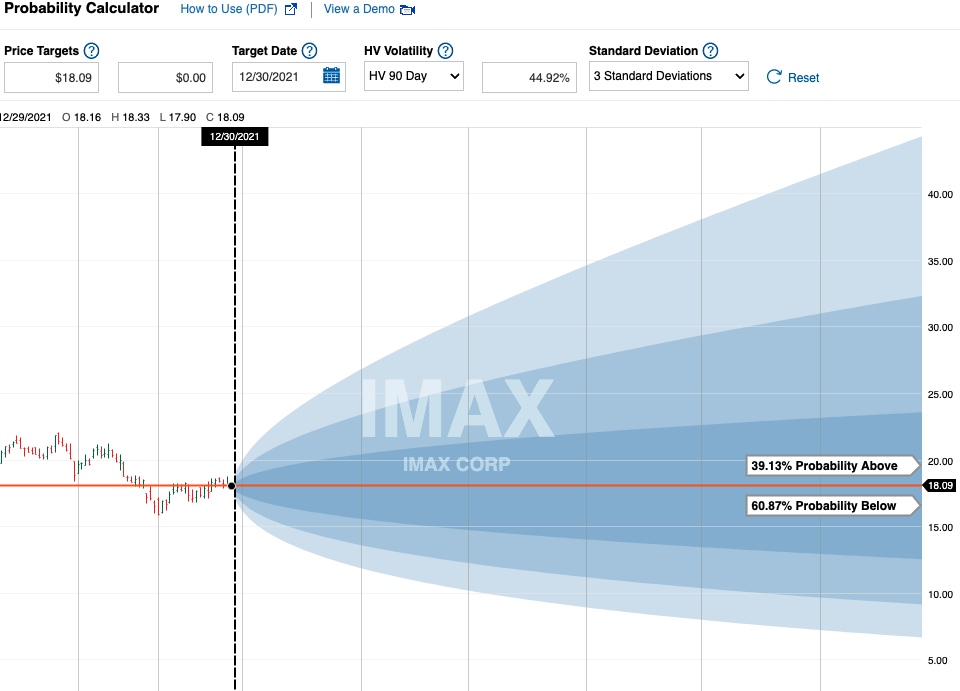

Fidelity Option Analyzer

Rating: 9/10

Who is it for: Advanced options traders

This tool - which is buried in Fidelity’s massive system within the options section - gives the probability for option price movements based on historical moves. I use it for selling puts OTM 2 months out.

It doesn't work great for extremely high volatility companies like TSLA, but for most others it is pretty spot on. I've used it some for buying calls and some for seeing the likelihood a company will move from an existing high to a new high.

Generally, I look for options that pay a nice premium for puts that are two standard deviations outside the projection and I sell those puts. I aim to make about 2K/mo in premium this way without much risk of a major crash putting me in a position where the put option could be exercised.

Fidelity Option Analyzer: Gives probability of option price moves

LevelFields.ai

Rating: 9/10

Who is it for: Anyone

LevelFields provides early alerts for major company events, gives some ready-made trading strategies, and provides data trends to help predict major price movements caused by events. While they tout the event analysis as their key feature, I've found it more helpful in finding good new stocks early and preventing bad decisions by being able to see how the stock is going to move after major news.

The system can be a bit slow at times but I have made a lot of money with it on swing trades and LEAPs. Their alerts got me into QCOM, BLDR, MU, LH, CVS, SIMO, AMAT, and DGX early along with a couple dozen others.

I gave it a 9/10 score because their UX does not enable you to search across the entire site, but they are very engaged with anyone who makes a suggestion, actually seem to be listening, and are making improvements to the site all the time which is cool.

www.Levelfields.ai: Gives the win rate for event-driven strategies

LevelFields.ai: depicts share price moves caused by news events

Stockcharts.com Seasonality

Rating: 6/10

Who it’s for: Advanced investors looking for alternative information

The site shows historical performance of stocks by month e.g. the percent of time the stock is up in December. I have not found this accurate enough to be a trading strategy for most stocks, but the seasonality component of the site is great context and background information for some stocks that do perform well during certain seasons, like Scotts Miracle Grow (SMG), which does well in the spring and summer financially but gets oversold during the Fall, Generac (GNRC), which earns money during extreme seasons where power outages happen frequently, and Vail Resorts (MTN), which makes money during winter and Q1, but trades in advance of those periods.

I will pair the seasonality indicators with my buy list, so when a stock I like is down during a month it is usually down and I see better seasonal trends coming, I will buy that stock and look for an exit point at the tail end of the good month.

Stockcharts.com Seasonality for SMG

TradingEconomics

Rating: 10/10 rating

Who it’s for: Commodity traders

This site is great for understanding the correlations between stocks and commodities and for tracking commodity prices. I was really missing this understanding for a long time for certain stocks and for stocks like Keurig Dr. Pepper (KDP) and Starbucks (SBUX), it's critical to watch coffee prices.

I was confused one day when KDP did a big buyback but the stock dropped. I checked this site and saw the price of coffee had risen the same day by 5%, which prevented the price increase I had expected and had been alerted about by LevelFields. I made about $18K on LPX just trading the trend lines on timber prices using options.

LPX vs Lumber Price Chart from Trading Economics

Zacks VGM Score

Rating: 8/10

Who is it for: Equity investors who like data analysis

Zacks.com VGM score is one feature there I really like. It stands for Value, Growth, and Momentum. It’s helpful for finding good value companies that also have some price momentum behind them. I’ve used their VGM best of the best screen to locate new, quality companies.

I have to add the caveat that you have to catch these picks early because the screen seems to only update every 3-6 months, and often the stock has already made its move by then. I use their lists for swing trades.

I used it to find a lot of high quality stocks outside my typical sectors, such as LPX, GNRC, DAC, MT, ZIM, and SEM. They charge a reasonable fee but they try to upsell you constantly which is really annoying, and their other services are very Motley Foolish - steer clear.

HighShortInterestStocks.com

Rating: 7/10 rating

Who it’s for: High risk investors

This tool has one main purpose: finding the next short squeeze and knowing where I'm going against the grain in terms of buying a stock that is heavily shorted. It was useful for knowing what the WallStBets crowd was into for a while, but now that they have come unwound, it’s better to use this site for your own due diligence.

I keep an eye out on these stocks for major news catalysts with my alerts, because that can quickly set off a little short squeeze. Admittedly, I use it less now than I did earlier in the year after losing money trying to predict another Gamestop, which I did make some money on early in the squeeze.

highshortintereststocks.com

OpenInsider - for insider trades

Rating: 7/10 rating

Who it’s for: Hardcore equity traders seeking long-term buy signals

Those who work at companies sell stocks for all kinds of reasons and are given stock options to work there. The only signal I’ve found that works is tracking what the CEO buys in mass quantities. It’s hard to find juicy ones like that in openinsider, but if you look hard enough it’s there.

There are many reasons for selling but only one reason for buying. It's a little hard to navigate this site but it has helpful info.

Openinsider.com for insider trades (not Congress)

Fidelity Analyst Upgrades/Downgrades

Rating: 7/10 rating

Who it’s for: Any equity investor

I used this area in Fidelity to track the latest analyst changes. I don’t look at reiterations, I mostly look for downgrades because they are infrequent and generally move stocks more than upgrades. I filter for UBS because that's the one that tends to have biggest impact I've seen.

The filters are hard to navigate and I really wish they had a longer timeframe but the info is useful for setting up short term trades and finding new short positions/swing trades.

Fidelity Analyst Upgrades/Downgrades

WhaleWisdom

Rating: 9/10

Who it’s for: Serious data hounds seeking long-term positions

WhaleWisdom is great for tracking what the hedge funds own. The down side is they don't track their options, so you don't know what they are hedging and the info by itself can be quite misleading if say, they own 3M shares of something but also carry 1M puts on it.

I use it for long term positions. I like to see what the big firms are trading and see if it matches what's going on in the market for those stocks.If they pull all out of a position, like they did below with Pinterest, that could be reason to sell or a reason to buy, assuming they are driving down the price to an unreasonable point. I bought.

Whalewisdom.com: track the hedge funds